Investment portfolio management is central to every financial adviser's value proposition and day-to-day life. How you go about portfolio management for your clients and your business creates client value and maximises your workflow efficiency.

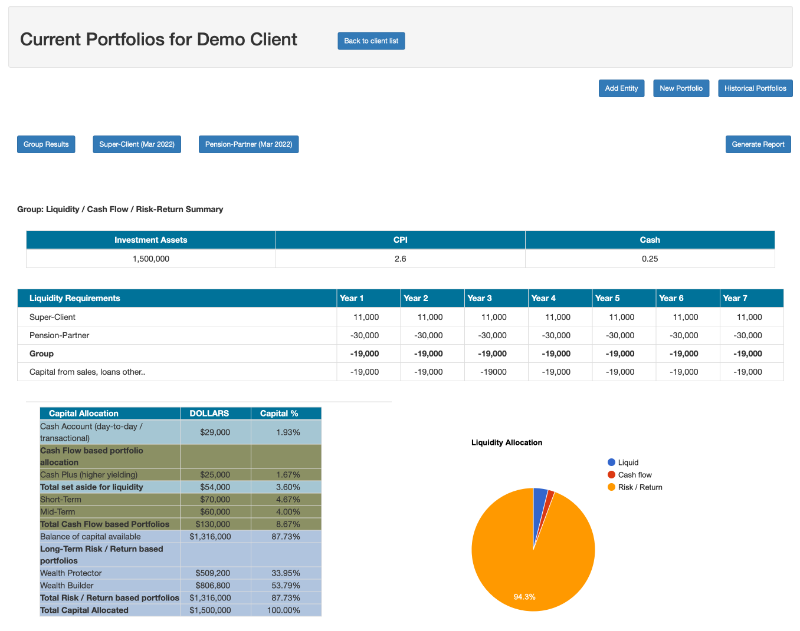

The Dynamic Asset Portfolio Construction Tool is software available to every adviser who utilises the Dynamic Asset Managed Account solution. Financial advisers can precisely match a client's investment goals and strategy to a specific targeted investment outcome. It does so by blending portfolio allocations to meet specific risk-adjusted returns over various periods.Let's use an example to illustrate how it works.

You have a client in their 40s. They have a spouse and two children, a top quartile income, significant expenses and an eye on their financial future.

Their short-mid-term financial goals are set up around the need to fund private school fees and part-fund upcoming home renovations. They also like to take an overseas holiday every year and require a plan to pay down debt over time. So there is a significant need for cash liquidity.

Their longer-term financial goals are focused on a target retirement age and maintenance of a similar standard of lifestyle they enjoy today. So the longer-term goals are about building wealth.

Like many clients, the adviser strategy is set against multiple short, mid and long-term cash flow, investment and wealth strategies.

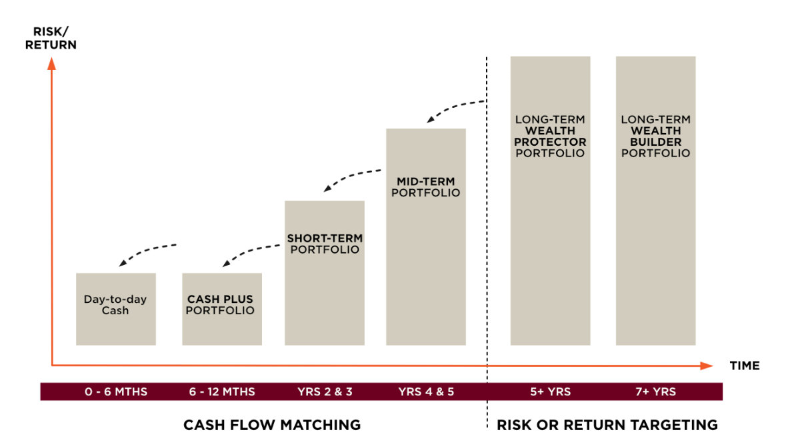

The first part of the Dynamic Asset solution is a range of portfolios that meet the endless combination of financial goals and strategies that a financial adviser needs to deliver against. The portfolios each target specific risk-adjusted returns over stated periods.

The second ingredient of the Dynamic Asset Managed Account solution is the Portfolio Construction Tool. The easy-to-use and powerful desktop software allows advisers to manage multiple objectives simultaneously. After setting up the client's financial goals, you can then infinitely blend portfolio allocations to achieve each goal.

The benefits are significant:

- Target outcomes are transparent and easily communicated to your client.

- Reporting on each goal is provided through your platform reports.

- Your value to the client is focused on their goals.

- You have ready-made client best interest compliance because your investment solution and products match your client's financial goals and circumstances.

The result is highly specific and targeted portfolio management that is incredibly easy to execute.

The Portfolio Construction Tool is just one way the Dynamic Asset Managed Account solution delivers what you and your clients need - while maximising your efficiency and freeing time to grow your business.

Dynamic Asset can help

Contact us today to learn more about Dynamic Asset's technology tools and how they can work for your business.