Financial advisers regularly undertake an exploration of client goals to gain a better understanding of their clients. However, the targeting of specific financial goals in portfolio management is still not commonplace. The reliance on risk profile, in effect, dislocates client goals from Portfolio Management and makes it harder for investor clients to understand the value of financial advice.The current status quo is that investments are generally built around a reference to a ‘benchmark’ such as shares, property or fixed interest – and the many derivations thereof. These portfolios are constructed using Modern Portfolio Theory, based on the assumptions of the Efficient Market Hypothesis. The aim is to create an ‘optimal’ Strategic Asset Allocation (SAA) to match a Risk Profile. Your stated risk profile then determines your investments allocation.

This is all good theory, but as we know, the real world doesn’t always work that way. Markets are not always efficient and predictable, and past behaviour is not necessarily reflective of future behaviour.

Then there is a question about whether the idea that how someone feels about their investments will perfectly match what they need to achieve their stated goals. In practice, they seldom match up. While it’s essential to understand an investor’s risk tolerance, using an SAA approach to design portfolios is not to designed to align with their goals.

Investing with a focus on matching client goals to portfolio targets is a simple, rational approach. It targets explicitly known needs. It’s far more intuitive to understand why you are making an investment, which helps overcome a raft of behavioural finance issues. Also, it helps address strategic challenges such as sequencing risk and income/cash flows planning in retirement. It can be used to enhance the application of Modern Portfolio Theory in the real world.

While the ‘why’ can be readily understood, some fundamental differences in ‘how’ goals-driven portfolio management differ from traditional SAA investing. Typically, the main differences are:

- To target specific objectives through a cycle, portfolio managers that target risk-adjusted returns use Dynamic Asset Allocation (DAA) to invest only into assets they believe will achieve their goals at a particular point in time

- DAA portfolios are actively managed with a focus on future performance rather than historical benchmarks

- DAA encompasses much broader asset allocation ranges, allowing an active portfolio manager greater flexibility in what asset classes and investments they can invest into

- DAA portfolios generally have a greater ability to allocate to alternative asset classes or investment strategies such as equity long/short, infrastructure, commodities (soft and hard), CTA and global macro

- Given the more defined investment objectives, there is a much greater focus on the risk (volatility) of asset classes. The aim is to limit the extent and severity of loss of capital value. As a result, DAA portfolios that target specific risk-adjusted returns exhibit a strong focus on capital protection

- Actively managed portfolios generally do not benchmark against traditional markets, such as shares and property, due to their volatility and ambiguous relevance to the outcomes required by investors.

Due to these differences, the skillset required to build and manage a goals-driven DAA portfolio is different from traditional managers. It requires a specialised and highly active approach to asset allocation. While institutional investors commonly use DAA, it’s far less common to find portfolio managers that use DAA for retail portfolios.

In fact, given the history and current status quo of investment managers, it’s not that easy to identify investment managers. Some managers hold themselves up to Goals Based Investment managers, but in reality, that may be more marketing than substance. Care should be taken when identifying a Goals Based Investment solution that you believe suits your needs.

If you are interested in the logic of DAA portfolio management, it’s essential to understand what to expect. With a different approach comes different outcomes.

Firstly, it’s essential to understand what not to expect from goals-driven DAA portfolios. Just because you ‘target’ an outcome doesn’t mean that it is ‘guaranteed’. All investment involves risk regardless of how you do it. You will still experience the volatility of your capital. Your investments will still go up – and down. Results will not be achieved in a straight-line month after month. The ‘target’ is that the result will be achieved over the stated investment timeframe, short or long-term.

There are, however, specific attributes that you can expect from goals-driven DAA portfolios.

Primary amongst these is that if you are targeting specific outcomes and managing diligently to that purpose, you should expect a higher probability of achieving that outcome at any particular point in time compared to an SAA managed portfolio. If it improves the likelihood of you achieving your goals, that is a good thing as it can help provide some peace of mind.

You should expect less volatility and a greater degree of capital protection.

These are two crucial points to bear in mind. Numerous surveys point out that the top priorities for investors are: (1) peace of mind and (2) protection of capital. Investment returns come in 4th on the list of priorities.

Finally, diversified goals-driven DAA portfolios will not behave like traditional markets or benchmarks. Market outcomes become irrelevant as they are likely to have little to do with the targeted result. For example, if you have a CPI + 5% target return, does it matter what the share market does?

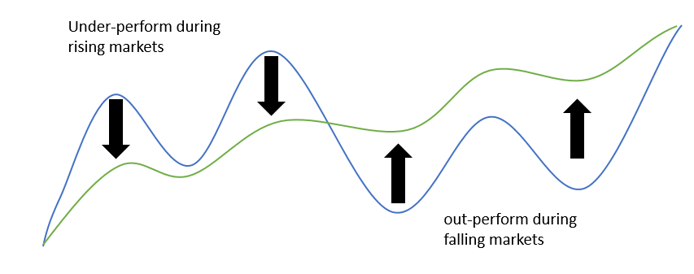

Combining these factors, you should expect that a DAA portfolio with lower volatility would under-perform during a rising market and that it will out-perform during a falling market.

Not surprisingly, DAA portfolio management is gaining understanding and acceptance among financial planners and retail investors. The reasons are obvious and straightforward; it makes sense, provides more reliable outcomes, and easily applies to specific investor goals and circumstances.

Investment managers, such as Dynamic Asset Consulting, have built and managed goals-driven DAA investment portfolios available to retail investors and financial planning firms.

Advisers that focus on client goals benefit from increased levels of client understanding, engagement and satisfaction. All of which adds to the value the service provides to their clients.

About Dynamic Asset

Dynamic Asset is a transformational business solution for financial advisers. Established in 2013 by financial advisers, Dynamic Asset provides class-leading managed account investment portfolios and business solutions for Australian financial advisers and their clients. The portfolios are designed to meet particular investment goals across liquidity and risk-return criteria.

The differentiated portfolios are used to manage client portfolios either individually or blended into an overall portfolio to suit their unique investment goals. The range of portfolios across both super and non-super means that Dynamic Asset provides the most complete whole of business Managed Account solution in Australia.

For more information on the Dynamic Asset managed account solution, please contact us.